The information you need to make your sustainability ambitions a reality

In this edition

- Budget 2023: Canada’s potential to become a ‘clean electricity superpower’

- IPCC: Importance of carbon removal in climate overshoot scenario

- OSFI’s first ‘climate-sensitive’ prudential framework

- ‘Breakthrough’ High Seas Treaty – businesses take note

- Nuclear power’s green labelling – UK vs EU

- A closer look into EU’s climate and energy diplomacy

- First-of-a-kind catastrophe bond linked to carbon credits

- New technical guidance covers commercial real estate assets

- Milestone for circular economy and recycling industry

- Three pathways to a circular plastics system in Europe

- First-ever U.S. water standard and the impact for utilities

- Get ready for nature-related risk management and disclosure

- How biodiversity risks impact the financial sector

- Podcast: The EU Carbon Border Adjustment Mechanism: Implications for global trade

Budget 2023: Canada’s potential to become a ‘clean electricity superpower’

On March 28, 2023, Canada released Budget 2023 with a focus on affordable energy, good jobs and a growing clean economy. A key goal targets Canada’s potential to become a ‘clean electricity superpower’, requiring investments to strengthen our competitiveness in the clean economy.

Among the investments and incentives announced: a 15% refundable tax credit to accelerate clean electricity; a refundable tax credit for clean technology manufacturing, equal to 30% of the cost of investments in new machinery and equipment; and a Clean Hydrogen Investment Tax Credit between 15% and 40% of eligible project costs.

Recognizing that the U.S. Inflation Reduction Act (IRA) poses a major challenge to our competitiveness in the clean economy, did Budget 2023 go far enough? The federal announcement compared Canada’s market-driven approach to emissions reduction, against the U.S.’s heavy reliance on new industrial subsidies to reduce its emissions – thus framing Canada’s approach as targeted.

Read our CIBC Capital Markets Research: Budget 2023 – Aiming High, Hitting Low and Canada’s Carbon Capture Disadvantage. View our Insights video on The 2023 Federal Budget – Assessing the Impact.

IPCC: Importance of carbon removal in climate overshoot scenario

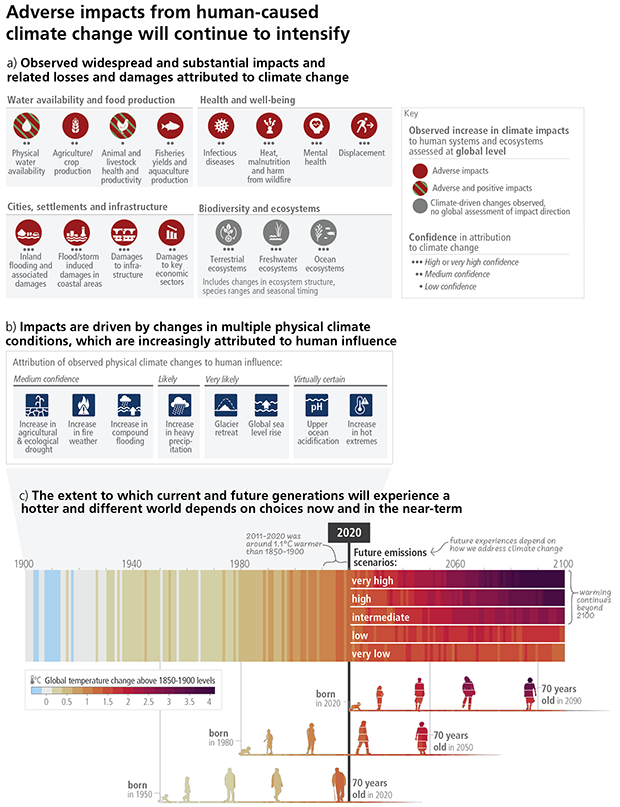

‘Every increment of warming results in rapidly escalating hazards’, warns the Intergovernmental Panel on Climate Change (IPCC) in their latest AR6 Synthesis Report. But the warning comes with a hopeful note that multiple, feasible and effective options are available today to reduce greenhouse gas emissions.

An example is carbon dioxide removal (CDR) approaches. The report states that if warming exceeds the 1.5C Paris Agreement scenario, we must look to the additional deployment of CDR to gradually reduce and sustain net negative global CO2 emissions.

Considering CDR’s importance to future warming scenarios, it is critical to reduce any barriers and enable commitments to scale the CDR industry in the near-term. This guide on how companies of all sizes are making carbon removal possible, provides five steps on how to incorporate CDR investments into corporate climate plans.

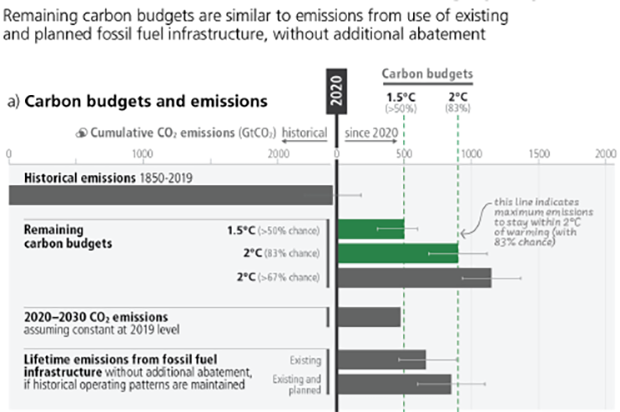

Chart: Remaining carbon budgets to limit warming to 1.5C could soon be exhausted, and those for 2C largely depleted

Source: IPCC (2023), AR6 Synthesis Report

OSFI’s first ‘climate-sensitive’ prudential framework

OSFI (Office of the Superintendent of Financial Institutions) published its first ‘climate-sensitive’ prudential framework1 for the management of climate-related risks by Federally Regulated Financial Institutions (FRFIs).

Guideline B-15: Climate Risk Management sets out expectations in two chapters covering Governance through five key principles, and Financial Disclosures that establish minimum reporting requirements. This will apply to Domestic Systemically Important Banks (DSIBs) and Internationally Active Insurance Groups (IAIGs) starting fiscal year-end 2024. For all other FRFIs, the guidelines will become effective at fiscal year-end 2025.

Banks and insurers must ensure their preparedness to implement climate change disclosure, measurement, and reporting frameworks. OSFI affirms these align with the expectations of global and domestic investors, and will monitor updates from the International Sustainability Standards Board (ISSB)’s next publication of the Standard IFRS S2 Climate-related Disclosures.

‘Breakthrough’ High Seas Treaty – businesses take note

Under a ‘breakthrough’ High Seas Treaty, UN member countries will put more money into international efforts for marine conservation and create rules on the use of and access to marine genetic resources.

The agreement was reached on March 3, 2023, after two decades of talks facilitated by the UN’s Intergovernmental Conference on Marine Biodiversity of Areas Beyond National Jurisdiction. This also builds on prior goals established by the UN’s Sustainable Development Agenda and last year’s COP15 Global Biodiversity Framework – where countries, including Canada, pledged to protect 30% of land, inland water, and marine and coastal areas, by 2030 (‘30×30 target’).

Businesses globally should take note. Like with climate, the ‘ocean emergency’ will require scaling-up pollution remediation and other ocean-action based on science and innovation. The new framework will set rules governing the share of profits from marine genetic resources – such as ocean plants and animals – important to many industries including food, pharmaceuticals, and cosmetics. A deeper focus on marine conservation could also attract more funding for the development and deployment of ocean-based clean technologies.

Nuclear power’s green labelling – UK vs EU

Nuclear power will be included in the UK’s green taxonomy, according to the UK Government’s Spring Budget 2023. The move, subject to consultation, is expected to boost longer-term public and private investment in the energy system, and give nuclear producers access to the same incentives as renewable energy.

The Government is also launching a first stage competition for Small Modular Reactor (SMR) designs from domestic and international developers. Leading technologies will be selected by year-end, and if viable, may be co-funded by the Government for development in the UK. Larger gigawatt-scale projects may be considered thereafter.

In separate news, the EU proposed a Net-Zero Industry Act, part of the Green Deal Industrial Plan to bolster clean technologies manufacturing. According to Nucleareurope, the proposal under-recognizes the role of nuclear power in Europe. Without fully supportive policies, there is concern that EU producers may not have an equal footing to compete with other jurisdictions.

A closer look into EU’s climate and energy diplomacy

On March 9, 2023, the EU affirmed that climate and energy diplomacy are core components of their foreign policy. This is particularly important as the bloc prepares for key discussions at the UN Climate Ambition Summit in September, and at COP28 Climate Convention in November.

Among the EU’s positions: calling for a global phase-out of unabated fossil fuels well ahead of 2050; urging for more ambitious emission reductions in all sectors, especially in transport (shipping and aviation); and encouraging partners to establish and extend carbon pricing instruments.

These positions could have significant impact for the private sector. With these upcoming global meetings throughout 2023, watch this space for developments.

First-of-a-kind catastrophe bond linked to carbon credits

Global reinsurer, Ariel Re, sponsored the issuance of a USD $125 million 3-year catastrophe (cat) bond with a carbon offset feature – a first for the cat bond market. Cat bonds are risk-linked securities that transfer a specific set of risks, such as storms and earthquakes, from a ceding sponsor company to capital markets investors. Ultimately, these securities play an important role for (re)insurance ecosystem, enabling recovery for communities’ insured losses.

If a qualifying loss event occurs, Ariel Re will offset the carbon impact from housing rebuilds and from building and vehicle replacements, through carbon credits. As there is no current directive to build back greener, there is an opportunity to achieve emissions reductions with lower-carbon options.

In February, the World Bank issued an Emissions Reduction-Linked Bond that provides a return linked to Verified Carbon Units (VCUs). As investors look for more exposure to carbon credit assets, we will likely see more innovative capital markets structures emerge.

New technical guidance covers commercial real estate assets

PCAF (Partnership for Carbon Accounting Financials), in collaboration with Carbon Risk Real Estate Monitor and GRESB, released technical guidance for the accounting and reporting of real estate-related operational greenhouse gas emissions.

Accounting and reporting of financed emissions for real estate assets can differ from corporate emissions. To decarbonize an entire property or benchmark a building’s operational emissions profile against that of its peers, the guidance takes a ‘whole-building approach’ to gain a complete understanding of all emissions from an asset. It provides specific accounting and reporting recommendations for commercial real estate to allow further consistency in reporting.

On April 25, 2023, PCAF will host a webinar and panel discussion on the newly released technical guidance.

Milestone for circular economy and recycling industry

Closed Loop Partners and Brookfield Renewable announce the establishment of Circular Services – the largest privately held recycling company in the United States.

The new company was funded with nearly one billion dollars, committed by Brookfield, the Closed Loop Circular Plastics Fund, the Partnership Fund for New York City, and six other leading companies concerned about rising plastic waste. This marks a significant milestone in the transition to the circular economy, as more institutional and corporate capital is catalyzed to advance circularity at scale.

Circular Services owns and operates facilities across the U.S. and seeks to help municipalities and businesses eliminate the hundreds of billions of dollars spent annually on landfill disposal costs by ensuring that valuable commodities are recycled and reused in domestic supply chains.

Three pathways to a circular plastics system in Europe

The European Environment Agency (EEA)’s latest publication, Pathways towards circular plastics in Europe, highlights three pathways to a more circular plastics system in Europe.

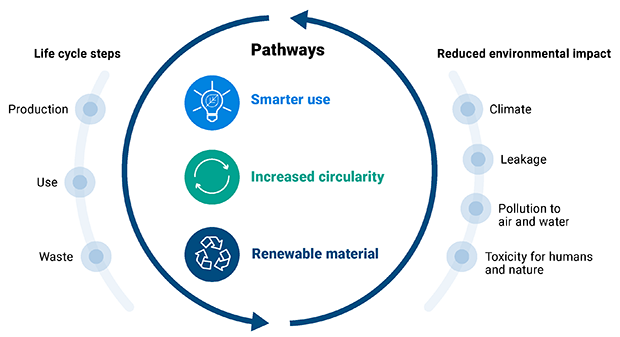

The first pathway, ‘smarter use’, calls for reducing the use of unnecessary plastics through less packaging, fewer single-use products, circular product design, extending product lifetimes and increasing reuse and repair. Second, ‘increased circularity’ for maintaining the value and utility of plastics through collection, sorting and recycling. Third, ‘renewable material’ for switching to renewable feedstocks to eliminate plastic pollution based on fossil fuels.

Businesses can influence and contribute to the development and implementation of these pathways, by investing in, and scaling-up, circular business models. Policymakers can affect the speed of pathway development by providing clear and timely policy frameworks. Citizens can contribute by demanding more sustainable and circular products and by being willing to engage with new, circular business models.

Chart: Pathways towards sustainable and circular plastics

Source: European Environment Agency (EEA), Pathways towards circular plastics in Europe

First-ever U.S. water standard and the impact for utilities

A first-ever U.S. national standard to address contaminants in drinking water was proposed by the U.S. Administration. Under the proposed regulation, which could be finalized by the end of 2023, legally enforceable levels of six types of manufactured chemical substances, or ‘PFAS’, could be set to safeguard public health.

The US. Environmental Protection Agency (EPA) estimates that domestic water utilities will need to spend between USD $770 million and USD $1 billion annually to comply with monitoring, reporting and reducing and treating PFAS. While the U.S. Infrastructure Act will set aside USD $9 billion to support efforts, the actual cost for engineering, installing, operating, and maintaining PFAS removal treatment technologies, including treatment media replacement and spent media destruction or disposal, could be much higher. Just one example of a water treatment enhancement project in North Carolina cost USD $43 million.

Get ready for nature-related risk management and disclosure

The Taskforce on Nature-related Financial Disclosures (TNFD) released an updated draft for its nature-related risk management and disclosure framework. In this version, TNFD outlines a tiered approach to disclosure metrics, made to align with global policy goals, including the COP15 Global Biodiversity Framework (GBF).

Since 2021, TNFD has been working to develop the framework in consultation with market participants. Currently, 200 global organizations from across different sectors are pilot-testing aspects of the draft framework. A final version is on track to publish in September 2023.

TNFD is an important tool in the toolbox. It will enable organizations of all sizes in all jurisdictions to identify, assess, manage, and disclose nature-related dependencies, impacts, risks, and opportunities. Like with the requirements of the Taskforce on Climate-related Financial Disclosures (TCFD), companies will face increasing shareholder and regulatory pressures to demonstrate nature-positive outcomes.

How biodiversity risks impact the financial sector

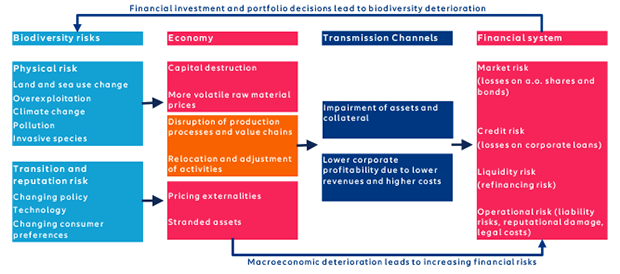

A report from Allianz Research, The new risk frontier in finance: biodiversity loss, highlights that financial institutions could face financial, market, reputational and legal risks when they invest in economic activities that cause adverse effects on biodiversity.

The report cites a financing gap of USD $711 billion per year to 2030 that is needed to stem biodiversity loss. Yet only 5% of that amount (as of 2019) came from green financial products, nature-based solutions, and carbon market products.

The sector can do more to contribute to financing the gap. In particular, insurance products that can support the restoration of natural habitats harmed by wildfires, floods, storms, droughts, or pollution accidents such as oil spills; and public-private partnerships with the insurance sector to provide institutional capacity to developing and emerging economies to implement adequate restoration activities.

Chart: How biodiversity risks impact the financial sector

Source: Allianz Research (2023), The new risk frontier in finance: biodiversity loss

Sustainability across CIBC

At CIBC, we are focused on our goal to make sustainability a reality for our clients and the communities we serve. Whether through greening their balance sheet or providing sustainability advisory services, our objective is to help our clients become global leaders in environmental stewardship and sustainability.

Podcasts

CIBC Capital Markets’ podcast series focusing on the evolving complexities of the sustainability landscape – with a view to addressing current issues in a concise format to help you navigate and take action.

Chart of the Day

Source: IPCC (2023), AR6 Synthesis Report

CIBC Capital Markets Insight Portal

Your one-stop destination for thoughtful and timely insights on today’s most critical issues.

Stay informed. Follow CIBC Capital Markets on Twitter and LinkedIn.

The CIBC logo and “CIBC Capital Markets” are trademarks of CIBC, used under license.