The information you need to make your sustainability ambitions a reality

In this edition

- Canada’s Green and Transition Finance Taxonomy Roadmap

- Carbonplace announces first CEO

- Alliance supports carbon removal as next ‘trillion-dollar industry’

- ‘Once in a generation opportunity’ will boost clean tech manufacturing in Europe

- Inaugural sustainability disclosure standards expected in Q2 2023

Why the World Bank’s carbon-linked bond is an important model

The World Bank issued a fixed income bond linking returns to the issuance of Verified Carbon Units (VCUs).

The USD $50 million five-year Emission Reduction-Linked Bond will finance a water purification project in Vietnam that will manufacture 300,000 water purifiers for 8,000 schools. Project outcomes will include clean water access for over 2 million children and reduce CO2 emissions by 3 million tons over 5 years by reducing biomass (like wood) used to boil and purify water.

The bond serves as an important model for future carbon-linked outcomes-based financing. For project developers, the structure provides access to finance in anticipation of future carbon revenues to deploy projects more swiftly. For investors, benefits are achieved when the project generates positive results. In this case, instead of coupon payments, VCUs issued by Verra from the water purification project will be paid semi-annually. Watch this space as more similar structures emerge.

Canada’s green and transition finance taxonomy roadmap

On March 2, 2023, the Sustainable Finance Action Council (SFAC) released a Taxonomy Roadmap Report, which includes a principles-based framework to guide the development of a taxonomy that would define green and transition activities within Canada.

The report contains 10 recommendations addressing the merits, design, and implementation of the taxonomy. It also prioritizes green and transition labels that focus respectively on low-emitting and decarbonizing emission-intensive activities. The approach to include transition, not commonly found in the 20+ other regional taxonomies, was taken to provide reliable access to capital to Canadian companies with credible transition plans, as well as inform the development of a transition taxonomy globally.

The taxonomy will be developed in two phases. Phase 1 will create a short-form taxonomy for priority sectors and activities by mid-2023. Phase 2 will publish a complete taxonomy by the end of 2025.

SFAC was established in May 2021 by the Government of Canada to lead the Canadian financial sector towards integrating sustainable finance into standard industry practice.

Carbonplace announces first CEO

Carbonplace announced Scott Eaton as the company’s first CEO. Eaton brings a wealth of experience from previous roles in fintech, structured credit trading and corporate finance. With Eaton, Carbonplace becomes an independent company, headquartered in London, UK.

Carbonplace is a global carbon credit transaction network established in 2020 by nine banks, including CIBC. Likened to the SWIFT of the carbon markets, it uses blockchain-enabled distributed ledger technology for the simple, transparent, and secure transfer of certified carbon credits.

Proof-of-concept transactions have already been undertaken with market participants, including Visa and Climate Impact X. Carbonplace is expected to launch later this year, and will be transformational for buyers and sellers in the carbon markets.

Carbon credits: Use ‘every tool in the box’

An open letter in support of high integrity carbon markets was issued by Sylvera and an industry group of buyers, project developers, industry bodies, ratings agencies, data providers, investors, conservation and non-profit organizations.

To meet the Paris Agreement goals, the group is calling for the use of ‘every tool in the box, including carbon credits’ to avoid climate action delay. They highlight the role of voluntary carbon credits as one of the few current mechanisms for funding wide-scale conservation and climate solutions. While there is a need to address inconsistent credit quality, initiatives by the Integrity Council for the Voluntary Carbon Market will help to bolster confidence in a high integrity carbon credit market.

Carbon credits introduce a de facto cost of carbon (for emissions not covered by other carbon trading schemes), creating additional incentives for buyers to reduce their emissions.

Interim guidance for aviation companies ready to set net-zero targets

A new technical report by the Science Based Targets initiative (SBTi) provides interim guidance for aviation companies that are ready to submit net-zero targets now.

Building on existing SBTi guidance and criteria, the report overlays a Breakthrough decarbonization scenario from Aviation Vision 2025. It models the demand for net-zero carbon aircrafts and fuels, leading to a peak in fossil jet fuel use in 2025 and elimination of the same by 2050. The report also recommends that aviation companies choose an alternate base year outside of the COVID-19 pandemic years of 2020-2022 as these were anomalous in terms of industry emissions.

Carbon emissions from commercial flights are set to triple by 2050 as travel and freight demand surges. The interim guidance offers a pathway to reduce emissions with efficient demand management, technologies and sustainable fuels.

Alliance supports carbon removal as next ‘trillion-dollar industry’

A new Carbon Removal Alliance (CRA) was formed comprising of over 20 organizations, including companies who develop and buy carbon removal. The CRA sees an opportunity to lobby for more technology-inclusive policies that will catalyze a robust market for permanent carbon removal.

According to the CRA, less than 10,000 tons of CO2 has been permanently removed from the atmosphere by new technologies —1 million times short of the annual scale needed. In scaling permanent carbon removal, the sector has the potential to be a multi-trillion dollar economic opportunity within decades.

Policies, like the U.S. Inflation Reduction Act, can stimulate public and private investments into deploying carbon removal technologies, which can include direct air capture, biomass sinking, enhanced weathering and others.

Industry calls for CDR standards body

A 70-member group led by CarbonPlan is calling for the creation of an independent standards initiative that would provide a trusted stamp-of-approval for long duration Carbon Dioxide Removal (CDR) protocols.

The group advocates for robust measurement, reporting and verification (MRV) standards to ensure that approaches for removing and storing CO2 support the integrity of claimed permanent removals. The initiative involves establishing a working group to further codify guidelines for assessing the performance of different CDR approaches; reviewing and approving quantification protocols; and establishing guidelines for independent 3rd party verification.

The CDR market is relatively nascent and in short supply. This initiative is important because without standardized approaches, CDR projects will not be able to attract the large-scale investments it needs.

Why is CCS under the spotlight?

The International Institute for Sustainable Development (IISD) warns of the Canadian oil and gas sector’s overreliance on Carbon, Capture and Storage (CCS) solutions to meet near-term emissions reduction targets by 2030. Timeline, efficacy and cost issues are among the reasons cited.

In Canada, CCS projects take an average of five years, from a project’s announcement to infrastructure buildout. Of the currently operating CCS projects, only 0.5% of national emissions are being captured, plus CCS does not address emissions from downstream fuel uses. It is also very expensive – as much as CAD $200 per tonne for currently operating projects.

This spotlight questions the opportunity cost of investing in CCS and the intensifying risk of stranded assets for Canada’s oil and gas sector as demand for oil and gas declines. The IISD advocates for more near-term emissions cuts, such as through new methane regulations.

‘Once in a generation opportunity’ will boost clean tech manufacturing in Europe

Europe’s new Green Deal Industrial Plan aligns incentives to boost the competitiveness and capacity of clean technology manufacturing. European Commission President von der Leyen coined the new plan as a ‘once in a generation opportunity’.

The plan has four pillars: 1) simplified regulatory environment, to include a Net Zero Act for fast-track permitting on strategic projects, and a Critical Raw Materials Act to ensure access to those materials; 2) faster funding, to include use of public and private financing to spur clean tech innovation, manufacturing and deployment; 3) enhancing skills, to include up-skilling and re-skilling programs; and 4) open trade for resilient supply chains, to include global cooperation such as the creation of a Critical Raw Materials Club of nations, and Clean Tech/Net Zero Industrial partnerships.

EU’s clean tech start-ups ecosystem is worth over EUR 100 billion in 2021, doubling in value since 2020 and is expected to see further growth under the new plan.

EU renewable hydrogen rules to impact domestic and foreign producers

New rules defining renewable hydrogen have been proposed by the European Commission. The rules would set requirements on the production of renewable fuels of non-biological origin (RFNBO) covered in two related Acts.

The first defines conditions under which producers can be RFNBOs based on an ‘additionality’ principle, by demonstrating that RFNBOs are produced from renewable electricity. The second provides a methodology for calculating the life-cycle of greenhouse gas emissions for RFNBOs.

The requirements would apply to both domestic producers and producers from third countries who export renewable hydrogen to the EU. A proposed certification scheme would ensure compliance with the EU framework so that fuels can be counted toward Member State’s renewable energy target. The EU aims to reach 10 million tonnes of domestic renewable hydrogen production and 10 million tonnes of imported renewable hydrogen in line with the REPowerEU Plan.

UK Cleantech attracts record VC investments

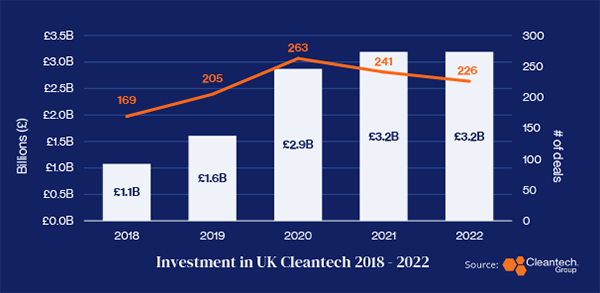

According to research by Cleantech Group, the UK’s cleantech sector attracted GBP 3.2 billion in venture capital (VC) in 2022, equaling the record investment of GBP 3.2. billion in 2021, and doubling since 2019. While deal numbers decreased to 226, from 241 in the previous year, the average deal size is up.

The second consecutive record year in 2022 is notable because global VC investment trends contracted last year, including by 16% in the EU, and 24% in the US.

Despite the early stage investment landscape being well-developed in the UK, larger growth funds are scarce. To supercharge further growth, the research calls for targeted interventions, including new spinout models for technology transfer to get new ventures out of the lab; innovative mechanisms to support first commercialization and increase private funding at Series B+; and better connectivity within the cleantech ecosystem to unlock new investment and increase regional diversification.

Chart: Investment in UK Cleantech, 2018-2022

Source: Cleantech Group (2022), Cleantech for UK

U.S. tax credits underpinning shift to solar energy – but for how long?

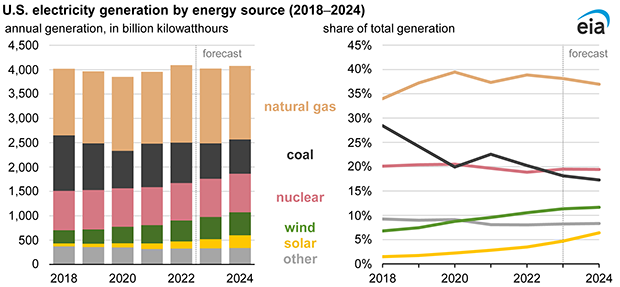

The U.S. Energy Information Administration (EIA)’s Short Term Energy Outlook notes a shift in electric power generation coming from solar projects, now accounting for 3% of total generation in 2022.

Solar photovoltaic capacity in 2022 stood at 74 gigawatts (GW), which is three times the capacity than back in 2017. It is expected to expand by another 63 GW by the end of 2024, which will raise Solar’s projected share to 6%. Factors like declining construction costs and tax credits are underpinning this shift.

EIA is also exploring the effects of U.S. policy adjustments on renewable energy investment tax credits (ITC) and production tax credits (PTC). In scenarios that would extend ITCs and PTCs through 2050, solar could account for 25% of total generation, while a gradual phase down (‘sunsetting’) scenario could see solar account for 4% less, at 21%, in total generation. Electricity producers take note.

Chart: U.S. electricity generation by energy source (2018-2024)

Source: U.S. Energy Information Administration (2023), Short-Term Energy Outlook

Inaugural sustainability disclosure standards expected in Q2 2023

The International Sustainability Standards Board (ISSB) expects to issue its inaugural sustainability disclosure standards by the end of Q2 2023. The final version will include disclosure of Scope 3 emissions, when material, in addition to Scope 1 and 2.

An implementation date was also set, starting in January 2024. This will also help the investor community who have been pushing to see more comprehensive and consistent sustainability-related disclosures from companies.

Companies underprepared for the new rules can take some comfort – the ISSB recognizes that the global standards will be new for many and plan to introduce further guidance and programs to support adoption. The ISSB will also engage with other jurisdictions to coordinate standard-setting that should help to harmonize disclosures. Watch this space!

Companies underprepared for incoming climate disclosure regulations

In a new report, CDP examines whether companies are disclosing credible climate transition plans. For a climate transition plan to be considered credible, CDP require disclosure against 21 key indicators, such as board-level oversight, scenario analysis, financial planning, and policy engagement.

Of the 18,600 companies reviewed, 4,100 said they had a climate transition plan. But of this, only 81 (0.4%) provided disclosure against all 21 indicators; and 2,300 (13%) disclosed against a set of 14 to 20 indicators. 6,520 (35%) plan to develop a climate transition plan within two years.

The findings ultimately show that companies are underprepared for the wave of incoming climate disclosure regulations, such as from the Securities Exchange Commission, European Union, UK Transition Plan Taskforce and others. The report warns that the lack of preparedness could increase risks to businesses, including litigation.

Climate change causes fifth costliest year in history for insurers

The impact of climate change on communities is tangible, as 2022 saw new extreme weather records from windstorms, floods, droughts and heatwaves.

According to Aon’s 2023 Weather Climate and Catastrophe Insight report, some 421 notable global natural disasters took place last year, responsible for USD $313 billion in economic losses. Just 42% of losses were insured, leaving a protection gap of 58%, or USD $181 billion.

Billed as the fifth costliest year in history for the industry, the report serves as a wake-up call to sectors like insurance, government, real estate, emergency management and banking to work with businesses and clients to build physical resilience, accelerate solutions to market and de-risk climate-related investments.

Sustainability across CIBC

At CIBC, we are focused on our goal to make sustainability a reality for our clients and the communities we serve. Whether through greening their balance sheet or providing sustainability advisory services, our objective is to help our clients become global leaders in environmental stewardship and sustainability.

Podcasts

CIBC Capital Markets’ podcast series focusing on the evolving complexities of the sustainability landscape – with a view to addressing current issues in a concise format to help you navigate and take action.

Chart of the Day

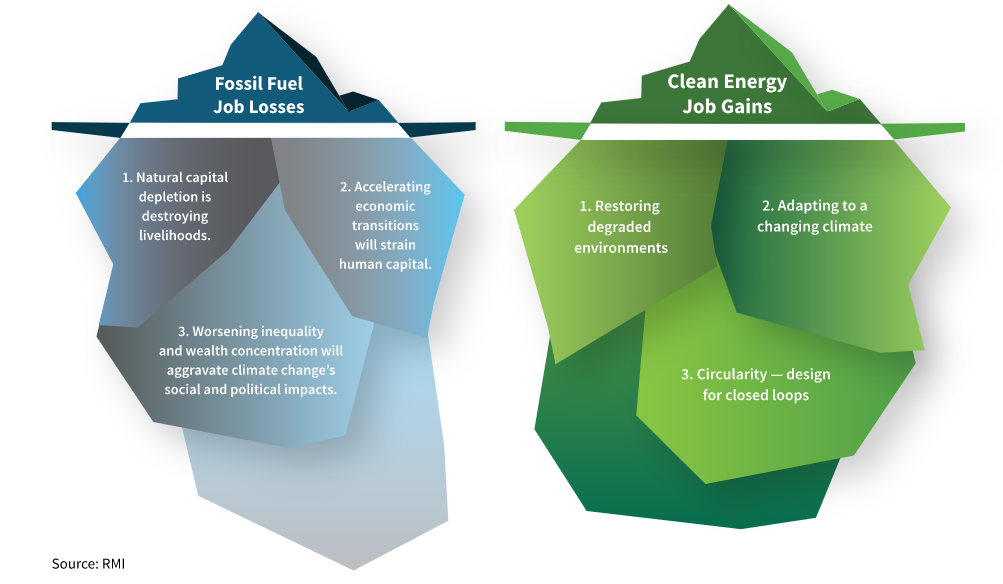

The switch to a carbon-free economy is the biggest economic opportunity of our era, according to the Rocky Mountain Institute (RMI).

Chart: Viewing the green jobs transition in a broader context of sustainability and adaptability

Source: Alfaro-Pelico, Paul, et al. (2023), Realizing the Green Jobs Promise, RMI

CIBC Capital Markets Insight Portal

Your one-stop destination for thoughtful and timely insights on today’s most critical issues.

Stay informed. Follow CIBC Capital Markets on Twitter and LinkedIn.

The CIBC logo and “CIBC Capital Markets” are trademarks of CIBC, used under license.