The information you need to make your sustainability ambitions a reality

In this edition

- ‘Geological Net-Zero’ – what is it and why is it important?

- Could the first CCP-approved carbon credits be issued later this year?

- Landmark blueprint for decarbonization in transportation sector

- Did you know? PPPP is the new PPP

- Transforming the carbon accounting ecosystem

- Sustainability across CIBC – 2023 Outlook and Year-end Update

World’s first carbon border tax: implications for global trade

The EU provisionally agreed the Carbon Border Adjustment Mechanism (CBAM) which aims to equalize trade competitiveness for EU importers and reduce carbon leakage.

From October 2023, EU importers will have to report the amount of embedded GHG emissions in their imports from six covered sectors: iron and steel, cement, fertilizers, aluminum, electricity and hydrogen. Additional sectors may be added in time.

From 2026, EU importers will have to purchase CBAM certificates corresponding to embedded emissions – billed as the world’s first major carbon border tax levy. CBAM aims to gradually phase-out free allowances for covered sectors under the EU Emissions Trading System (ETS) by 2034.

Crucially, CBAM will require non-EU exporters who sell to EU markets to track, verify and report the direct and indirect emissions in their products. The impact to global trade could be significant, eventually increasing the cost of materials for carbon-intensive producers or disrupt supply chains. An exception may apply for countries with an equivalent carbon pricing mechanism for covered commodities.

‘Geological Net-Zero’ – what is it and why is it important?

Rt. Hon. Chris Skidmore, former UK energy minister, published Mission Zero: An Independent Review of Net-Zero with 129 recommendations for more ambitious climate targets in the UK.

Of note, is the inclusion of ‘geological net-zero’ – for each quantity of fossil carbon extracted, the same quantity must be geologically sequestered in the same year. Skidmore calls on the UK government to set a 10% storage obligation target, or Carbon Takeback, on domestic fossil fuel producers by 2035 in order to restore carbon dioxide to the geosphere. The concept has the potential to influence UK and international ambitions toward ‘geo-zero’ by 2050, in line with net-zero.

Other proposals include “backing business” through incentives for investment in decarbonization, such as tax credits and capital allowances; and “using infrastructure to unlock net-zero” with a strategy supporting the building and adaptation for new green energy sources, like hydrogen.

An upcoming Sustainability Agenda podcast episode on The Carbon Takeback Obligation will have experts discuss the concept in more detail. Watch this space.

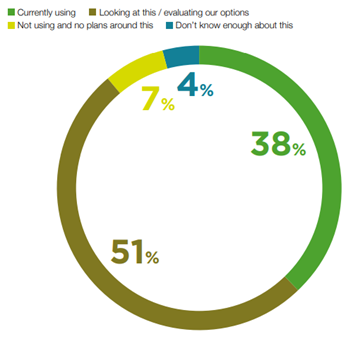

Survey finds 38% of businesses using voluntary carbon credits

Corporate Minds on Climate Action is a survey of 502 executives from 13 business sectors across the U.S, UK, and Europe. It found that businesses are seeking ways to counterbalance emissions by investing in the voluntary carbon market.

Key findings include: 89% believe carbon credits can help to compensate for annual unabated emissions that organizations are not yet able to eliminate; 51% said carbon credits allow them to take immediate climate action alongside ongoing work intended to directly reduce emissions in the longer term; and 49% say credits are a cost-effective solution for making progress towards sustainability goals. When asked about the utility of carbon markets, over a third (38%) said their organizations are currently using carbon credits, and over half (51%) said they are considering it.

As efforts to improve trust and transparency in the voluntary carbon markets materialize, we expect to see more businesses utilize carbon credits as part of their net-zero strategies.

Chart: Organizations currently using carbon credits as part of their climate actions

Source: Corporate Minds on Climate Action, We Mean Business, Conservation International, January 2023

Why is everyone talking about REDD+ carbon credits?

On January 18, 2023, a team of investigative journalists released results from a nine-month investigation of forest offsetting projects, or REDD+ schemes. They claim that 94% of Verra-approved REDD+ carbon credits have no benefit to the climate. Many companies purchase these credits to support environmental claims.

Verra disputes the findings, saying the investigation “massively miscalculates the impact of REDD projects”. Verra also highlights that the investigation used “synthetic controls” – which compare a project to a control scenario – that do not account for project-specific factors. Verra defends the integrity of its baseline methodology and published further fact-checking to clarify claims.

REDD+ is only one type of voluntary carbon credit and is backed by a UN-framework that aims to curb deforestation and forest degradation.

The future of VCM regulation?

Rostin Behnam, chair of the Commodity Futures Trading Commission (CFTC), believes the agency can play a role in the voluntary carbon markets (VCM).

In remarks at a recent conference, Rostin highlighted potential future areas of inquiry by CFTC’s Agricultural Advisory Committee and said VCM presents an opportunity for the agricultural economy, but must adhere to basic market regulatory requirements.

Could CFTC be signaling an interest in regulating VCM? CFTC currently has the power to investigate suspected fraud and manipulation in spot markets, including cryptocurrencies. The same principles could apply to carbon markets.

In June 2022, CFTC convened a panel to discuss the supply and demand for high quality carbon offsets, including product standardization, market structure and data requirements. In October 2022, seven U.S. senators wrote a letter to the CFTC requesting it to “pursue strong oversight” over VCM. Watch this space.

Could the first CCP-approved carbon credits be issued later this year?

The Integrity Council for the Voluntary Carbon Market (ICVCM) plans to publish the Core Carbon Principles (CCPs) in March 2023. The CCPs, which underwent an extensive public consultation last year, represent a global threshold to qualify high-integrity carbon credits.

From May 2023, ICVCM will officially begin to review the different credit types assessed against the CPPs criteria. By Q3 2023, they may formally launch CCP-approved programs and credit types for projects, like for example cookstove or reforestation projects, that meet the CPPs’ high climate, environmental and social integrity criteria. The first issuance of CCP-labelled carbon credits could follow soon thereafter.

The CPP-label will make it easier for investors to recognize and price a high integrity carbon credit – regardless of whether it is a removal or reduction credit, or where the project is located.

What will it take to scale-up novel CDR?

The State of Carbon Dioxide Removal is the first comprehensive assessment of the amount of carbon dioxide removal (CDR) – capturing and storing atmospheric CO2 – deployed around the world.

It found a substantial CDR shortfall because of too few plans by countries to scale CDR than what is needed in scenarios to meet the Paris Agreement temperature goal. Closing this gap will require rapid growth of novel CDR – an increase by a factor of 30 by 2030, and by a factor of 1,300 by mid-century.

Innovation in recent years has focused on land-based biological CDR methods such as biochar and soil carbon sequestration. A rise in patents (with China the lead country and Direct Air Capture the most patented technology) is attracting more investment into this space. However, to scale novel CDR, policymakers must deliver actionable policy proposals that acknowledges CDR challenges, like policy costs, hazards, and land use conflicts

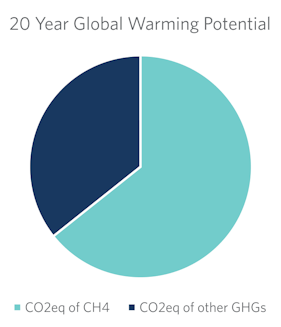

How oil and gas can reduce their carbon footprint

Six tons of human-made greenhouse gases is attributed to oil and gas-related processes like extraction, transporting and refining, according to a recent analysis by the Rocky Mountain Institute (RMI), and data from Climate TRACE.

The analysis recommends two priority areas the oil and gas industry could take to reduce their carbon footprint. First is to cut methane emissions, which accounts for two thirds of the industry’s 20-year Global Warming Potential (GWP). Solutions include initiatives that regularly evaluate and certify gas production according to independent standards, such as MiQ.

Second, is to prioritize the decarbonization of specific high-volume, high-intensity resources in countries and facilities that are not yet on a decarbonization pathway. Mapping tools, such as the Oil Climate Index plus Gas (OCI+), could help businesses, investors, and policymakers to identify and prioritize.

Chart: Methane as a share of Oil and Gas Industry Emissions (20-Year GWP)

Note: 20-Year GWP assumes that methane s 82.5 times more climate forcing than CO2.

Source: Climate TRACE and RMI

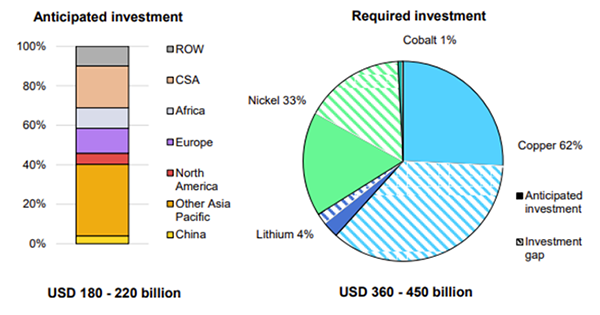

Mind the gap: Seven-fold increase in critical minerals demand by 2030

The International Energy Agency (IEA)’s 2023 perspectives on energy technology includes an outlook for mining and materials production.

Clean energy transitions require substantial material inputs, such as critical minerals and bulk materials. Demand for five key critical minerals – lithium, cobalt, nickel, copper, and neodymium – will increase 1.5 to 7 times by 2030. But gaps exist. Current lithium is expected to cover only two thirds’ of 2030 requirements. Mining capacity must be expanded, requiring an investment of USD 360 to 450 billion over the next three years.

More capacity is also needed to process bulk materials, like steel and cement, but too few announced projects are currently capable of “near zero emissions” production. In a Net Zero Emissions by 2050 (NZE) Scenario, these projects may yield just 10% of needs for steel and 3% for cement. Making “near zero emissions” production more commercially available is critical.

Chart: Anticipated investment in mining of critical minerals by region/country and required to meet mineral demand over 2022-2030 in the NZE Scenario.

Note: CSA = Central and South America. ROW + rest of the world.

Source: 2023 Technology Perspectives, IEA, 2023

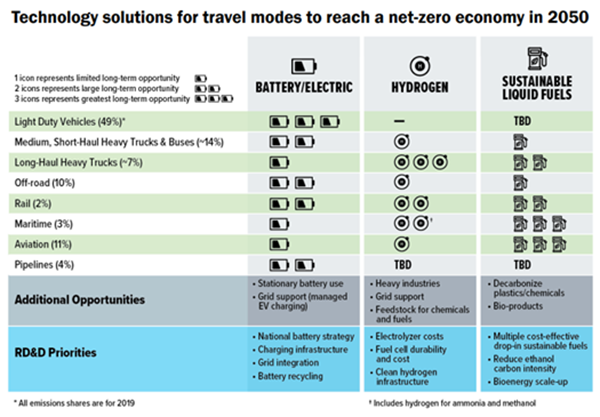

Landmark blueprint for decarbonization in transportation sector

The U.S. National Blueprint for Transportation Decarbonization, released in January, is a landmark ‘first-of-its-kind’ inter-agency framework that will incent decarbonization of the entire U.S. transportation sector. The goal is to achieve 100% clean electrical grid by 2035 and net-zero carbon emissions by 2050.

Last year, three U.S. agencies – the departments of Energy, Transportation, Housing; Urban Development; and the Environmental Protection Agency – agreed a memorandum of understanding to accelerate affordable and equitable clean transportation. The sector is currently responsible for one-third of all GHG emissions in the United States.

The blueprint will guide policymaking and work with private sector to develop and deploy clean energy technologies, such as electric vehicles, hydrogen and sustainable fuels. It will further support building-out clean transportation infrastructure – a boon for project developers.

Chart: Transportation Decarbonization Strategies – Transition to Clean Options

Source: Factsheet: US National Blueprint for Transportation Decarbonization, Office of Energy Efficiency and Renewable Energy, January 2023

Impact of EU’s buildings decarbonization strategy on banks

Climate Bonds Initiative is monitoring decarbonization measures in the European building sector, which accounts for a third of EU’s GHG emissions. Crucially, 75% of Europe’s buildings will require an energy efficiency renovation by 2050 to meet net-zero targets, underlining the need for a major program of upgrades and renovations.

An upcoming vote on the EU’s buildings decarbonization strategy will determine how ambitious the bloc is prepared to go. A key hurdle involves Mortgage Portfolio Standards, which would require mortgage lenders to report on the energy efficiency of their mortgage books.

Member States will also have to produce national renovation plans outlining their investment needs. CBI expects issuance of sovereign green bonds could be utilized to allocate funding for energy efficiency. Member States can choose to support private financial flows, like providing guarantees to mortgage banks, or greening national development banks, or offering grants and equity loans to low-income households. Watch this space.

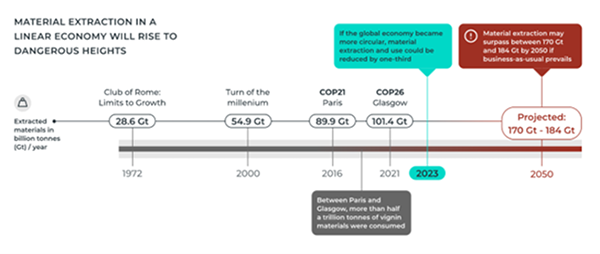

Why circular material management is important for businesses

Circle Economy’s Circularity Gap Report 2023 warns only 7.2% of the global economy is circular, meaning fewer materials are being recycled back into the economy. Global material extraction is rising to meet demand for roads, homes, and durable goods.

The report highlights four key global systems where, if a circular economy was fully implemented, could reverse the overshoot: food, manufactured goods and consumables, the built environment and mobility and transport. It asserts that virgin material extraction could drop by around one third (34%) and GHG emissions could be reduced enough to limit global temperature rise of 2 degrees.

How do we take action? Policymakers and business leaders can incorporate circular material management strategies – use less, use longer, use again, and make clean – to transition to a circular economy.

Chart: Material extraction is rising every year

Source: Circularity Gap Report 2023, Circle Economy, 2023

Did you know? PPPP is the new PPP

Giving to Amplify Earth Action is a new ‘ground-breaking’ initiative by the World Economic Forum that leverages philanthropic capital, alongside public and private partners, to generate $3 trillion a year toward climate and biodiversity goals.

Philanthropic giving can unlock funding for projects, like clean tech, because it is more nimble, tolerant of risks and driven by different values and long-term outcomes. Building on the concept of Public Private Partnerships (PPP), expect to see the role of Public Private and Philanthropic Partnerships (PPPP) rise in importance.

In separate news, Canada’s oldest philanthropic organization, the Ivey Foundation, is electing to wind-up operations by 2027 to fully disburse its entire $100 million endowment to advance Canada’s transition to a net-zero economy. In an open letter, Ms. Rosamond Ivey, board chair, makes the case that “philanthropic resources can, and in some cases should, be fully utilized for the most critical issues we face today”. More private funders could be inspired to follow suit.

From the academic corner: Top ESG-related themes to watch

Harvard Business Review published 2022: A Tumultuous Year in ESG and Sustainability. Among the top ten themes, are climate policy ‘wins’ including the US Inflation Reduction Act for its clean energy and electric vehicles tax incentives, and funding for clean tech manufacturing. Looking to 2023, focus will shift to the infrastructure needed to support the clean tech economy.

Meanwhile, Harvard Law School’s Forum on Corporate Governance published the Top 15 Anticipated ESG-related Considerations That Will Influence Strategy in 2023. They see shareholder ‘voting democratization’ will gain in popularity; water metrics will become a close second to emissions-related disclosures; and more companies will increasingly set internal carbon pricing, as stricter regulatory and investor dynamics within the carbon ecosystem materialize over the next 24 months.

How does your corporate governance compare?

A 2023 ESG Disclosure Study by Faskens LLP highlights how some of Canada’s largest public companies are tackling board oversight, management and disclosure of ESG-related matters.

The study found that 52% of TXS60 companies place primary ESG oversight on the full board and committee, compared to just 38% where primary oversight is held by committee only. The survey also shows that most companies are referencing some combination of one or more frameworks for their ESG reporting. Only about a fifth of companies received one or more ESG-related shareholder proposals. To incentivize and align executives with ESG goals, 68% of TSX60 companies are linking executive-based compensation to ESG metrics.

ESG metrics and disclosures are increasing in importance and influencing how companies should engage with their investors – which can ultimately impact access to capital.

Transforming the carbon accounting ecosystem

In Toward a Technology Ecosystem for Carbon Accounting, the Rocky Mountain Institute (RMI) believe that companies need a better understanding of the carbon implications of their decision-making. However, GHG emissions data is currently difficult to exchange and compare due to a lack of universally accepted standards.

In fact, there is no widely used common standard or data format for describing and exchanging emissions data. Existing platforms for reporting carbon data are either on an annual reporting basis – making data inherently out of date by the time it is shared – or too focused on organizational rather than product-level data where companies make operational decisions to lower carbon emissions.

RMI advocate for an integrated carbon accounting ecosystem, by making carbon data more comparable, interoperable, and machine-readable, and where data standards can be open-sourced. Companies should pay attention to the growing market for emerging software that are purpose-built to manage carbon emissions accounting and reporting.

Sustainability across CIBC

At CIBC, we are focused on our goal to make sustainability a reality for our clients and the communities we serve. Whether through greening their balance sheet or providing sustainability advisory services, our objective is to help our clients become global leaders in environmental stewardship and sustainability.

2023 Outlook and Year-end Update

Roman Dubczak, Deputy Chair at CIBC Capital Markets, led a discussion with Sustainability experts at CIBC Capital Markets on their observations from the last 12 months, and key themes for the year ahead.

With – Dominique Barker, Head of Sustainability Advisory, CIBC Capital Markets

Watch here. Running time: 8mins

With – Amber Choudhry, Managing Director, Debt Capital Markets, CIBC Capital Markets; and Siddharth Samarth, Managing Director & Head of Sustainable Finance, CIBC Capital Markets

Watch here. Running time: 12mins

Events

Recently, CIBC held its 26th Annual Western Institutional Investor Conference at Whistler, B.C.. Dominique Barker, Head of Sustainability Advisory at CIBC Capital Markets, shares her insights on some of the key sustainability themes gained from conversations at the 3-day event.

-

- 1. The energy sector’s journey to net-zero. Dominique provides insight into the need for competitive policies and incentives, Indigenous partnerships, and project capital. Watch here

- 2. The mining sector’s role in the low carbon transition. Dominique shares perspectives on the importance of critical minerals, decarbonization, and diversification. Watch here

Podcasts

CIBC Capital Markets’ podcast series focusing on the evolving complexities of the sustainability landscape – with a view to addressing current issues in a concise format to help you navigate and take action.

The CIBC logo and “CIBC Capital Markets” are trademarks of CIBC, used under license.